Asset Turnover Ratio Increase Means

Current ratio is a useful test of the short-term-debt paying ability of any business. You can also use our Receivable Turnover Ratio Calculator.

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Some sectors like retail will more likely see a good ratio around 2.

. Read more asset turnover ratio sales turnover accounts receivable and accounts payable ratio. Interpretation of the Ratio. Firstly determine the operating income of the company from the income statement.

The accounts receivables ratio on the other hand measures a companys efficiency in collecting money owed to it by customers. Compare your days in accounts payable to supplier terms of repayment. Assessment day for an income year of a life insurance company has the meaning given by section 219- 45.

Staffing ratios and productivity ratios. Current Asset Turnover Year 2 3854 766 503. Asset-based income tax regime has the meaning given by section 830- 105.

Asset of a sub-fund of a CCIV means any of the assets of the sub-fund ascertained in accordance with Subdivision B of Division 3 of Part 8B5 of the Corporations Act 2001. Over Q3 its busiest period the retailer posted 47000 in COGS and 16000 in average inventory. A higher ratio implies that management is using its fixed assets more effectively.

A high turnover may indicate unfavourable supplier repayment terms. A high AR turnover ratio is usually desirable but not if credit policies are too restrictive and. Inventory Turnover Ratio Examples.

If any company wants to increase the equity turnover ratio to attract more shareholders it may skew the equity by increasing the debt percentage in the capital structure. A ratio of 1 is usually considered the middle ground. The meaning is quite.

Particulars Company A in. In year 2 this ratio increased indicating that the company needed 303 days to collect its receivables. The receivables turnover ratio is an absolute figure normally between 2 to 6.

Staffing ratios are used to predict hiring need based on established organizational. For instance an asset turnover ratio of 14 means youre generating 140 of sales for every dollar of assets your business has. An asset is a resource with economic value that an individual corporation or country owns or controls with the expectation that it.

Cherry Woods Furniture is a specialized supplier of high-end handmade dining sets made from specialty woods. The formula for operating cash flow can be derived by using the following steps. If the turnover ratio is decreasing or the turnover in days is increasing the problem might indicate a downturn in the economy or in a particular.

Equity Turnover Ratio Example. Two different ratio methods are used in human resource forecasting. Treynors Ratio Treynors ratio indicates how much excess return was generated for each unit of risk taken.

Thats why its. The fixed asset turnover ratio reveals how efficient a company is at generating sales from its existing fixed assets. This move is very risky as by doing this the organization is taking on the burden of too much debt and eventually they have to pay the debt with interest.

Current ratio Current assetsCurrent liabilities 1100000400000 275 times. This indicates a slight decline in firms ability of generating sales through its current assets such as cash inventory. Current Asset Turnover Year 1 3351 656 510.

Year 2 witnessed a slight decrease of firms current asset turnover ratio from 510 to 503 comparing to year 1. To find the inventory turnover ratio. The higher the turnover the shorter the period between purchases and payment.

An asset turnover ratio measures the efficiency of a companys use of its assets to generate revenue. A low turnover may be a sign of cash flow problems. Since the working capital ratio measures current assets as a percentage of current liabilities it would only make sense that a higher ratio is more favorable.

It is the income generated from the business before paying off interest and taxes. Revenue is the total value of goods or services sold by the business. A ratio of 04 means youre only generating 040 for every dollar you invest in assets.

Accounts Receivable Turnover Days Year 2 325 3854 360 303. Total Asset Turnover Revenue Average Total Assets Fixed Asset Turnover. This means that the firm would have to sell all of its current.

A WCR of 1 indicates the current assets equal current liabilities. A receivable turnover ratio of 2 would give an average collection period of 6 Months 12 Months 2 and similarly 6 would give 2 Months 12 Months 6. Accounts Receivable Turnover in year 1 was 285 days.

Inventory Turnover Ratio Cost of Goods Sold Avg. Higher the value means fund has been able to give better returns for the amount of risk. It means that the company was able to collect its receivables averagely in 285 days that year.

Others particularly that are service-based will have a much lower ratio. A ratio of 21 or. The current ratio is 275 which means the companys currents assets are 275 times more than its current liabilities.

Its not risky but it is also not very safe. Higher ratio indicates that the companys product is in high demand and sells quickly resulting in lower inventory management costs and more earnings. A decrease in ratio figure for example 78 or 0875 means the company has a highly geared capital structure.

In the above example 76 or 1167 means the company has a low geared capital structure.

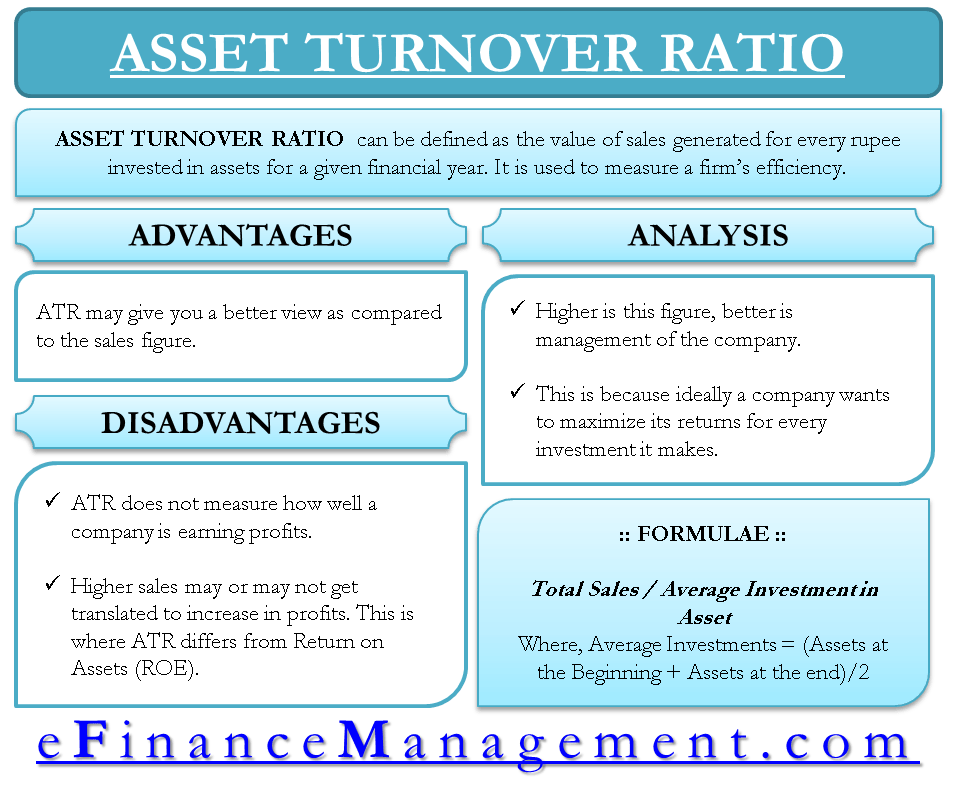

Asset Turnover Ratio Formula Meaning Example And Interpretation

Turnover Ratios Definition All Turnover Ratios Uses Importance Efm

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

No comments for "Asset Turnover Ratio Increase Means"

Post a Comment